Fill all data for whole the year / YEARLY

সারা বছরের তথ্য

Fields 2, 3 & 9 are mandatory.

1. Financial Year / Assessment Year

Select Fin Year

OLD & NEW REGIME Fin 2023-24 Asses 2024-25

OLD REGIME Fin 2022-23 Asses 2023-24

OLD REGIME Fin 2021-22 Asses 2022-23

OLD REGIME Fin 2020-21 Asses 2021-22

Fin 2019-20 Asses 2020-21

Fin 2018-19 Asses 2019-20

Fin 2017-18 Asses 2018-19

Fin 2016-17 Asses 2017-18

Fin 2015-16 Asses 2016-17

1a. Age Group

Less than 60 years

60 or above but less than 80 yrs

80 years or above

----------

-----------

1b. Standard Deduction for service person : চাকুরিজীবীদের জন্য স্ট্যান্ডার্ড ডিডাকশান: * Rs 40000 for 2018-2019 Financial year

Applicable

Not Applicable

----------

-----------

2. Gross Salary (/year): CLICK HERE to know it.

Rs.

3. Gross P Tax (/year):

Rs.

4.Income Tax Paid (if any /year)

Rs.

-- --

Other source of income fill up if applicable

5.Bank Interest from savings (SB ) accounts:

Rs.

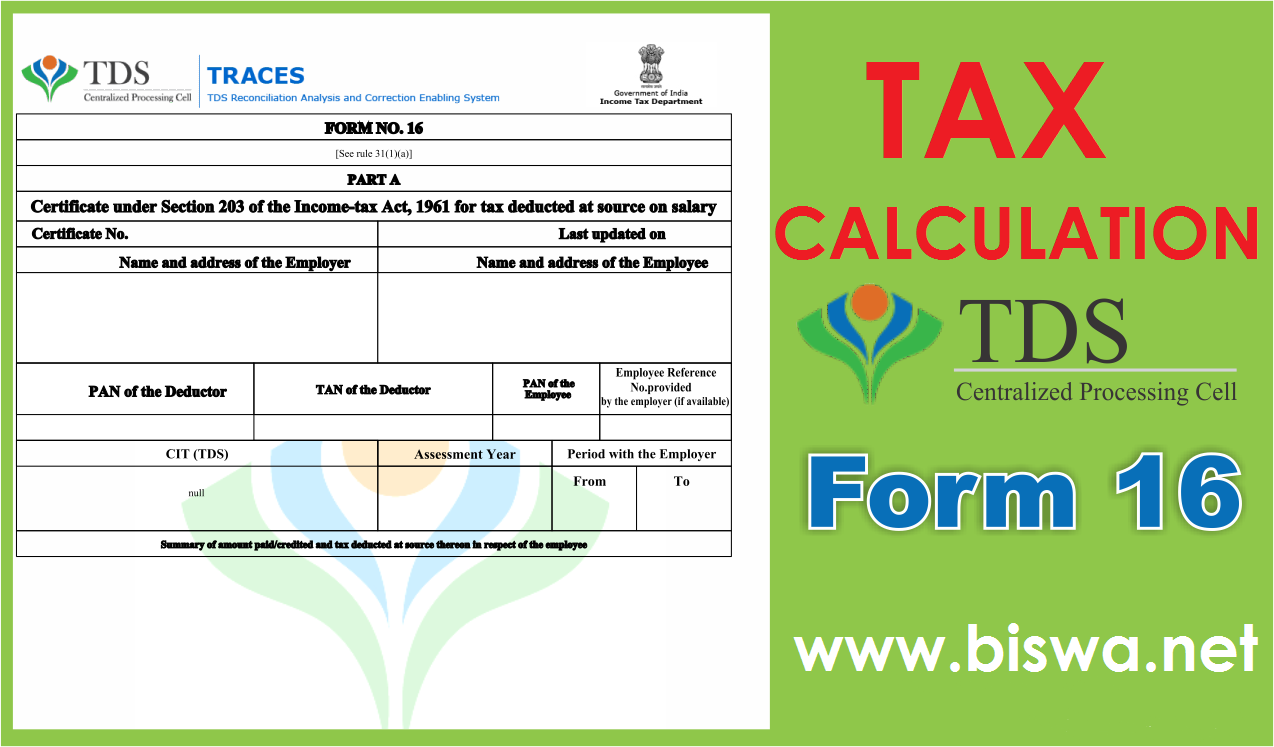

5a.Deposite Bank Interest

Rs.

80TTA MAX Exemption Available Circular [shows 40000] Tool: Income Tax of India shows 10000

10000

40000

6. [u/s 17(2)]PERQUISITES casual benefit get from office in addition to salary:

Rs.

7. [u/s 17(3)] profits in lieu of Salaries:

Rs.

8. Income from other source if any :

Rs.

-- --

(80C) Fill up the following which is applicable other wise keep blank

9. General Provident Fund (PF or GPF /year)

Rs.

10. Public Provident Fund (PPF /year):

Rs.

11. Group Insurance (GIS /year)

Rs.

12. LIC Premium (/year):

Rs.

13. PLI Premium (/year):

Rs.

14. Child Educational Expense (/year):

Rs.

15. House Building Loan Principal :

Rs.

16. Mutual Fund (/year):

Rs.

17. NSC (/year):

Rs.

18. Sukanya Samriddhi:

Rs.

19. Other Investment [under 80C]

Rs.

------------------- ------------------

20. NPS 80CCD(1B)

Rs.

-- --

(80D to 80U) keep blank which is not applicable

20. 80D Mediclaim

Normal

Including Parent Seniorctzn

Rs.

21. (80E) Interest on Education Loan:

Rs.

22. (80EE) Interest on House Repairing Loan: [Max 50000]

Rs.

23. (80G) Donation to

50% Deduction

100% Deduction

Rs.

24. If any Other (Name)

Rs.

24a. If any Other (Name)

Rs.

25. House Building Loan Interest :

Rs.

If you live in a rented house fill up the following, other wise not

26. [u/s 10(13A)] House rent exemption : Click Here to know.

Rs.

-- --

us 10(14)Exemption on allowance/ Keep blank if not applicable

27. Travelling allowance/transfer allowance

Rs.

-- --

Tax relief under sec 89 / Keep blank if not applicable

28. Tax relief under section 89:

Rs.

-- --

Tax relief 80CCC, 80CCD / Keep blank if not applicable

29. 80CCC Savings on specified

Rs.

30. 80CCD contribution to pension

Rs.

-- --

No information is stored in this website. Still you may keep blank

the following fields.

31. Name of the employee

32. Name of the Father of employee (for form 192 only)

33. Designation of the employee

34. Mobile no. of the employee

35. PAN no. of the employee

36. Name of the employer

37. Name of father of employer

38. Designation of the employer

39. TAN of the employer

40. PAN of the employer

41. Name of Office/Institution/

42. Address of Office/Institution/

43. Date of signature

42. Place of signature by