|

Fill all data for whole the year / YEARLY

|

সারা বছরের তথ্য

|

| Fields 2, 3 & 9 are mandatory.

|

|

1. Financial Year / Assessment Year

|

|

|

1a. Age Group

|

|

| ---------- |

----------- |

| ---------- |

----------- |

2. Gross Salary (/year): [u/s 17(1)]

If you do not know gross salary CLICK HERE to know it.

|

Rs.

|

|

3.Income Tax Paid (if any /year)

|

Rs.

|

| -- | -- |

|

Other source of income fill up if applicable

|

|

4.Bank Interest from savings (SB) accounts:

|

Rs.

|

|

5.Deposite Bank Interest

|

Rs.

|

|

7. Income from other source if any:

|

Rs.

|

|

8. [u/s 17(2)]PERQUISITES casual benefit get from office in addition to salary:

|

Rs.

|

9. [u/s 17(3)] profits in lieu of Salaries:

such as amount of any compensation received by an assesses

|

Rs.

|

| -- | -- |

|

us 10(14)Exemption on allowance/ Keep blank if not applicable

|

10.

Conveyance allowance,

Research allowance

etc [which are applicable in New Regime]

|

Rs.

|

| -- | -- |

|

Tax relief under sec 89 / Keep blank if not applicable

|

11. Tax relief under section 89:

special case/ keep blank

|

Rs.

|

| -- | -- |

|

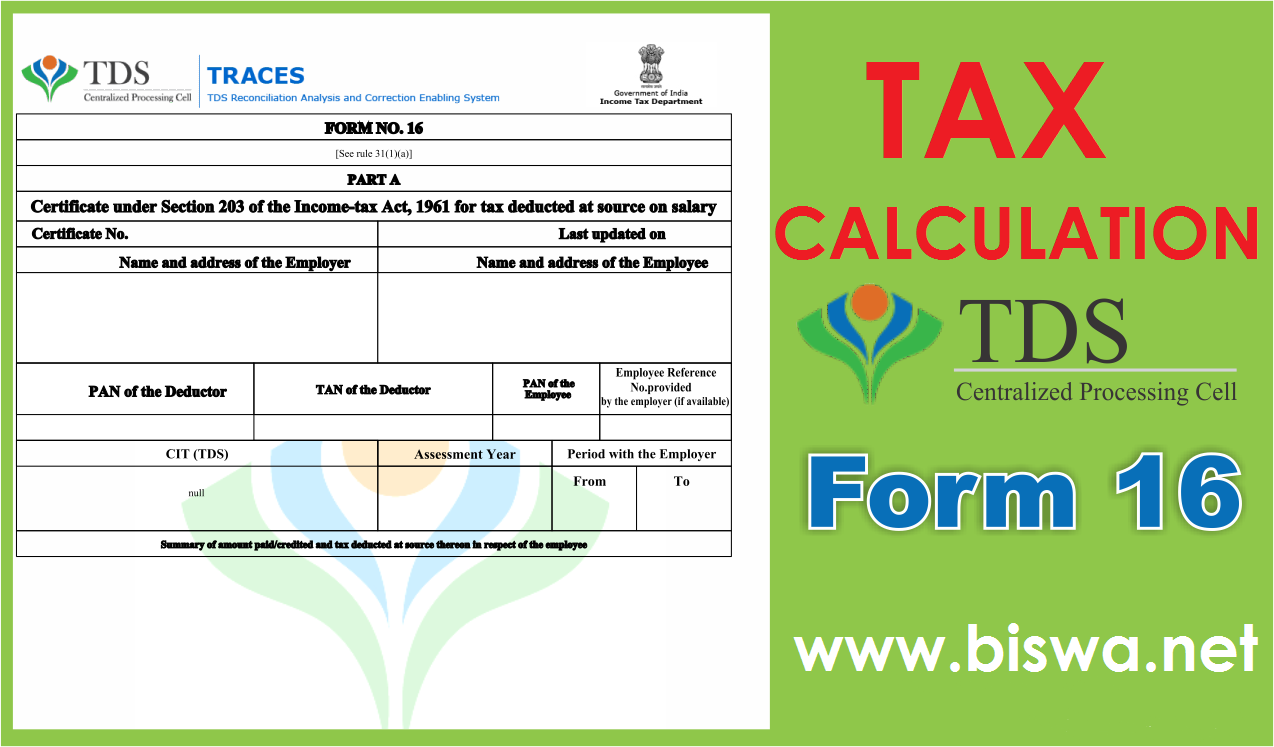

EMPLOYEE INFORMATION

|

12. Name of the employee

You may keep blank

|

|

13. Designation of the employee

You may keep blank

|

|

14. PAN no. of the employee

You may keep blank

|

|

15. Name of the employer

HM/DI/etc. You may keep blank

|

|

16. Designation of the employer

HM/DI/etc. You may keep blank

|

|

17. TAN of the employer

DI/etc. You may keep blank

|

|

18. PAN of the employer

DI/etc. You may keep blank

|

|

19. Name & Address of Employer/Institution/

School.

You may keep blank |

|

20. Date of signature by employer

You may keep blank

|

|

21. Place of signature by employer

You may keep blank

|

|

22. Name of father of employer

You may keep blank

|

|